FREE AUDIT PROCESS IMPLEMENTATION Course:

https://www.udemy.com/course/audit-process-implementation/?couponCode=A738B3356B71354485D0

Here is a list of the documented information required by ISO 9001:2015:

Scope of the Quality Management System (QMS):

- Document describing the boundaries and applicability of the QMS within the organization.

Quality Policy:

- Document outlining the organization's quality objectives and commitment to meeting customer requirements and enhancing customer satisfaction.

Quality Objectives:

- Document specifying measurable objectives that the organization aims to achieve within its QMS.

Procedures for Document Control:

- Documents detailing how documents are approved, reviewed, updated, and controlled within the organization.

Records of External and Internal Issues:

- Documented information related to the organization's understanding and assessment of external and internal factors that may impact its ability to achieve desired outcomes.

Records of Interested Parties and Their Requirements:

- Documentation listing stakeholders and their expectations, needs, and requirements relevant to the QMS.

Risk and Opportunity Management Plan:

- Documented information outlining how risks and opportunities are identified, assessed, and addressed within the organization.

Operational Planning and Control Documents:

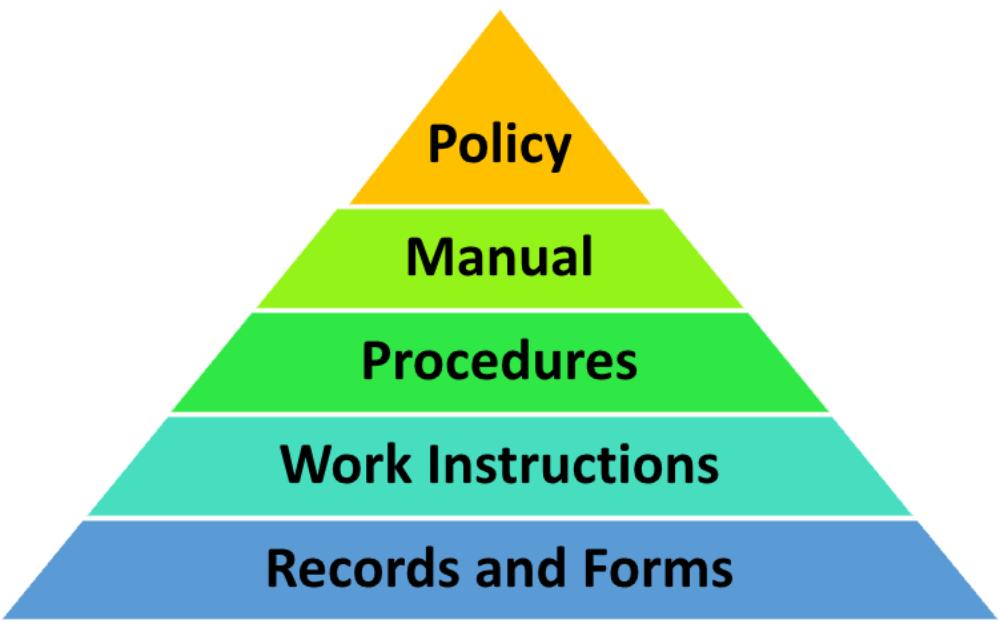

- Documents detailing procedures, work instructions, and specifications necessary to support the operation of processes and ensure product and service conformity.

Monitoring and Measurement Records:

- Records of monitoring and measurement activities performed to ensure conformity of products, processes, and the QMS.

Internal Audit Reports:

- Records of internal audits conducted to assess the effectiveness of the QMS and identify areas for improvement.

Management Review Records:

- Records documenting the results of management reviews, including decisions and actions related to the QMS.

Records of Nonconformities and Corrective Actions:

- Documentation of instances where products, processes, or the QMS did not meet requirements, along with actions taken to address them.

Records of Preventive Actions:

- Documentation of proactive measures taken to prevent the occurrence of nonconformities and improve the QMS.

Records of Changes to Documented Information:

- Documentation of changes made to documented information within the QMS, including the reasons for the change and any approvals obtained.

Training Records:

- Records of training activities conducted to ensure personnel competency in performing their assigned tasks.

Customer Communication Records:

- Records of communication with customers regarding product information, inquiries, orders, contracts, and feedback.

Supplier and Contractor Evaluation Records:

- Records of assessments and evaluations of suppliers and contractors to ensure their ability to meet requirements.

These are some of the key documented information requirements outlined in ISO 9001:2015. However, organizations may have additional documented information depending on their specific processes, products, and industry requirements.